Reuters

Jan 18, 2019

Tiffany holiday sales fall as Chinese tourists spend less

Reuters

Jan 18, 2019

Tiffany & Co tempered its yearly profit forecast on Friday after its holiday sales fell unexpectedly as Chinese tourists spent less globally and the U.S. luxury jeweler faced softer demand in Europe and at home.

Like other firms which sell luxury products, Tiffany relies on demand from China’s burgeoning middle class as consumer demand for its rings, pendants and bracelets remains subdued in the United States and Europe.

During the crucial November-December period, Tiffany’s worldwide same-store sales fell 2 percent while net sales dipped 1 percent, against its expectations of modest increases.

In a statement, Tiffany Chief Executive Alessandro Bogliolo blamed softer spending globally by foreign tourists, primarily Chinese, and external uncertainties which may have hit customer demand in Europe and the Americas region.

“Overall holiday sales results came in short of our expectations,” Bogliolo said in a statement.

Shares of Tiffany, which have fallen 22 percent in the past 12 months, slipped almost 1 percent in early trading following the news.

A slowdown in spending by Chinese tourists had also led Tiffany to shy away from raising its yearly profit targets in November.

However, customer demand at Tiffany stores in mainland China remained strong during the holiday season, the company said.

The New York-based jeweler’s underwhelming holiday period results mirror similar reports from other retailers. Macy’s, Kohls and other retailers reported disappointing results even as overall shopping during the 2018 U.S. holiday season reached a six-year high.

Smaller U.S.-based jeweler Signet on Thursday also reported lower holiday period sales and slashed its full-year profit forecast, driving its shares more than 20 percent lower.

Tiffany now expects full-year earnings around the lower end of its estimated range of between $4.65 and $4.80 per share.

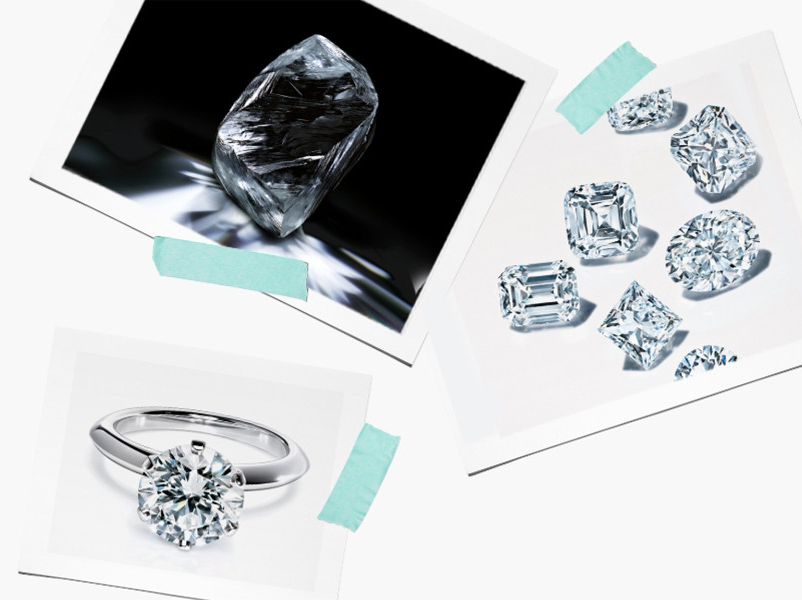

The jeweler, known for its engagement rings and Robin’s Egg Blue Boxes, said holiday sales of engagement and designer jewelry fell 3 percent and 8 percent, respectively.

Annual sales should rise 6 to 7 percent, the company said. It had earlier estimated growth in the high single percentage digits.

For the year ending January 2020, Tiffany expects earnings per share to rise in the mid-single digits and net sales to grow in low-single digits.

© Thomson Reuters 2024 All rights reserved.