By

Reuters

Reuters

Published

Sep 11, 2009

Sep 11, 2009

Clothing chain rue21 files for $125 million IPO

By

Reuters

Reuters

Published

Sep 11, 2009

Sep 11, 2009

NEW YORK, Sept 10 (Reuters) - Youth clothing chain rue21 Inc is seeking to raise as much as $125 million in an initial public offering, joining a recent spike in filings by retailers.

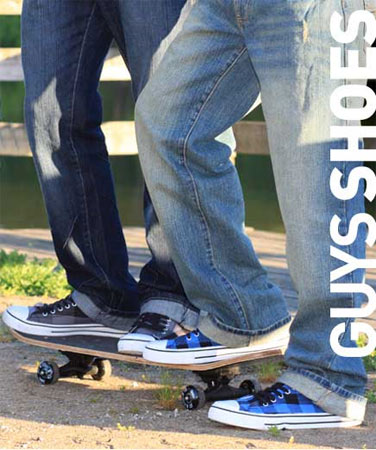

Photo: www.rue21.com |

Rue21, which operates 500 stores serving young adults in 43 states, according to a prospectus filed on Thursday 10 September with the U.S. Securities and Exchange Commission, said it would use some of the proceeds to pay down all or some of its debt, which totaled $29.2 million as of Aug. 1.

Rue21 plans to expand and estimated it could have more than 1,000 stores within five years, including 100 new stores it plans to open in 2010.

Rue21's same-store sales rose 4.1 percent in the half-year ended Aug. 1, 2009, while overall sales rose 33.3 percent to $233.1 million, with net income of $8.3 million over the same period.

The submission of the prospectus comes on the heels of a spike in IPO filings by retailers, including those of the parent of health supplement chain Vitamin Shoppe and discount chain Dollar General Corp.

There has not been an IPO by a retail chain in the U.S. since beauty products chain Ulta Salon, Cosmetics & Fragrance Inc (ULTA.O) went public in October 2007 in a $153.7 million IPO, according to Thomson Reuters data.

Rue21 was originally founded in 1976 as a low cost specialty apparel retailer. As part of a turnaround earlier this decade, the chain sought bankruptcy protection in February 2002 and emerged within fifteen months with fewer stores.

The Warrendale, Pennsylvania-based company is owned by funds advised by private equity firm Apax Partners LLP and BNP Paribas North America Inc (BNPP.PA).

The IPO will be managed by Bank of America Merrill Lynch, Goldman Sachs & Co, and JPMorgan.

(Reporting by Phil Wahba; Editing by Phil Berlowitz)

© Thomson Reuters 2024 All rights reserved.