Reuters

Apr 11, 2009

Bain sees 2009 global luxury sales down 10 pct

Reuters

Apr 11, 2009

NEW YORK, April 10 (Reuters) - Luxury goods sales worldwide could fall 10 percent this year to $201 billion, with the U.S. market in the greatest retreat, according to a forecast reported on Friday 10 April by the Wall Street Journal.

|

The forecast, to be released Tuesday 14 April by consultants Bain & Co, updates Bain's earlier forecast of just five months ago, which called for a 7 percent decline in everything from diamonds to designer dungarees.

Bain now expects luxury-goods sales will drop as much as 20% in the first two quarters of this year before stabilizing in the second half, the Wall Street Journal said.

Bain sees U.S. sales of high-end clothing, accessories, tableware, cosmetics and jewelry dropping by 15 percent this year. In Europe and Japan, those sales are expected to decline 10 percent.

Bain sees apparel suffering the most, down 15 percent globally from a year ago.

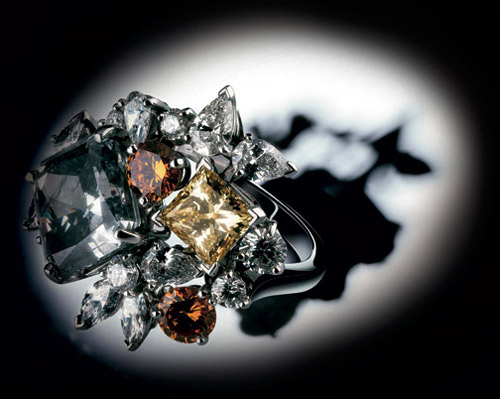

Sales of jewelry and watches are forecast to slide 12 percent, while those of high-end shoes and other leather goods are expected to decline 10 percent.

The United States, Europe and Japan account for more than 80 percent of worldwide luxury good sales,

Smaller emerging markets are expected to pick up some of the slack, with Bain expecting sales in China to rise 7 percent and those in the Middle East are seen increasing 2 percent, the Wall Street Journal said.

The sharp drop in demand for designer clothing and other luxury goods has been especially hard on upscale retailers, including Saks Inc (SKS.N), which reported that March same-store sales fell 23.6 percent from a year ago, while the newspaper noted that Neiman-Marcus Group Inc [NMRCUS.UL] said its same-store sales dropped 29.9 percent last month from March 2008 levels.

Nordstrom Inc (JWN.N), another high-end retailer, reported March same-store sales fell 13.5 percent from a year ago. (Reporting by Ilaina Jonas; Editing by Jan Paschal)

© Thomson Reuters 2024 All rights reserved.